In 2023–2025, healthtech funding in Africa grew ~7% year-over-year, and Nigeria’s Helium Health, MyDawa, Remedial Health, and Yodawy emerged as top deals.

Many global digital health startups assume emerging markets are “too risky” — but the truth is, the fastest growth is in the gap between access, trust, and local adaptation. If you have a credible local partner, lean operations, and culturally attuned product — you can accelerate into ~100M+ user markets with far less competition than in the U.S./Europe.

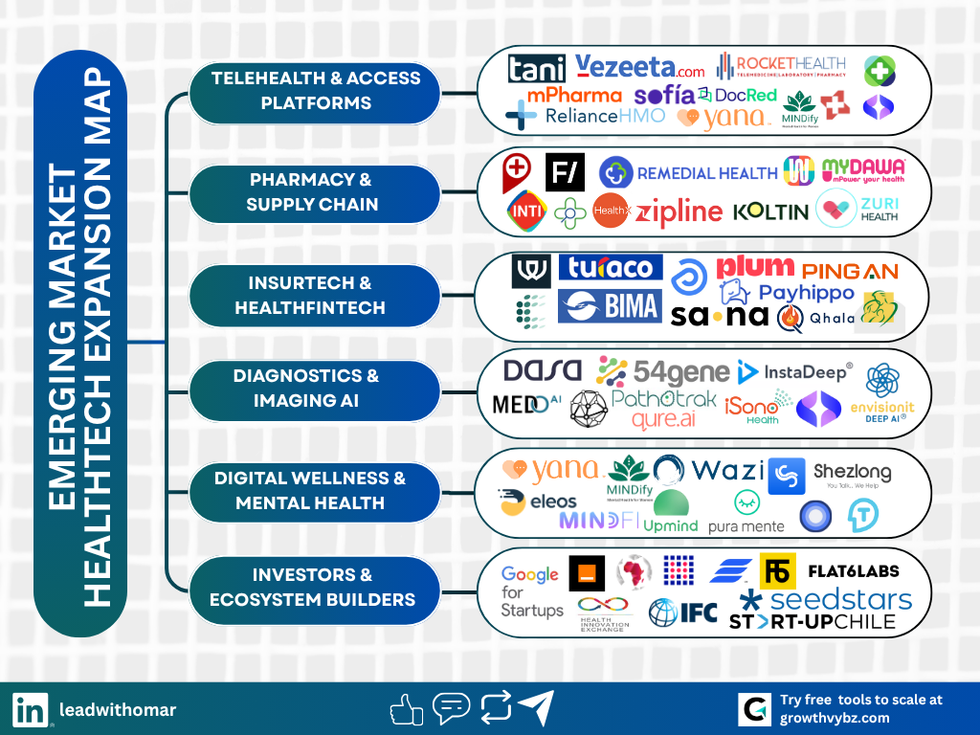

In this post, we break down 6 key verticals in the LATAM + Africa healthtech expansion landscape, highlight dozen+ emerging players you should watch, and outline a GrowthVybz-style expansion roadmap you can adopt (or hire) to enter these markets profitably.

🚀 Key Categories & Startups (with Descriptions & Context)

Below are the six categories from your map, updated with examples that have verifiable presence or funding as of recent years.

1️⃣ Telehealth & Access Platforms

Connecting millions of patients to affordable primary and specialist care.

| Startup | Country | Description |

|---|---|---|

| Tani Salud | Mexico | Transparent surgery marketplace improving price discovery for patients. |

| Vezeeta | Egypt / MENA → Africa | Appointment and teleconsultation giant expanding across Africa. |

| Rocket Health | Uganda | End-to-end telemedicine plus lab and pharmacy logistics. |

| mPharma | Ghana / Pan-Africa | Digitizes pharmacy networks and primary-care delivery. |

| Reliance HMO | Nigeria | Hybrid insurance + tele-consultation for SMEs and consumers. |

| Sofía | Mexico | Subscription-based digital health clinic with 24/7 chat and visits. |

| DocRed | Chile | B2B teleconsultation platform connecting clinicians and corporates. |

| Zuri Health | Kenya | Multi-country virtual-care platform integrating WhatsApp consultations. |

| Healthlane | Cameroon / Nigeria | Preventive health and wellness diagnostics chain. |

| Yana | Mexico | Spanish-language mental-health chatbot expanding into tele-care. |

| Mindfy | Chile | Holistic wellness & mental-health sessions via mobile app. |

2️⃣ Pharmacy & Supply Chain Tech

Fixing fragmented medicine logistics and inventory visibility.

| Startup | Country | Description |

|---|---|---|

| LifeBank | Nigeria | On-demand delivery of blood, oxygen, and critical supplies. |

| Field Intelligence | Nigeria | Predictive inventory automation for pharmacies. |

| Remedial Health | Nigeria | Streamlines ordering for 1000+ community pharmacies. |

| Zipline | Ghana / Rwanda | Drone delivery of vaccines and lab samples to remote areas. |

| MyDawa | Kenya | Licensed e-pharmacy and tele-prescription platform. |

| Wasoko | Kenya | B2B e-commerce network distributing health & FMCG goods. |

| Farmalisto | Colombia | Online pharmacy & chronic-care management hub. |

| Droguería Inti | Bolivia | Major LATAM distributor digitizing supply tracking. |

| mPharma Mutti | Zambia / Nigeria | Affordable drugs via franchise model. |

| Koltin Health | South Africa | Cold-chain and med-device logistics startup. |

| HealthX Africa | Kenya | Tele-pharmacy & diagnostics integration platform. |

3️⃣ InsurTech & Health FinTech

Making healthcare affordable through digital payments, micro-insurance, and credit.

| Startup | Country | Description |

|---|---|---|

| Turaco | Kenya | Low-cost micro-insurance bundled with digital wallets. |

| CarePay | Kenya / Ghana | Health payment platform connecting payers, providers, patients. |

| BIMA | Ghana / Pan-Africa | Micro-insurance pioneer active in 10+ countries. |

| WellaHealth | Nigeria | Subscription-based micro-coverage for malaria & primary care. |

| Sana Benefits | US → LATAM | SME health-insurance startup exploring LATAM partnerships. |

| Plum | India → Africa | Group health-benefits platform targeting emerging SMBs. |

| OKO Health | Côte d’Ivoire | Crop + health micro-insurance via mobile channels. |

| Ping An Global Voyager | China → LATAM | Cross-border health-finance investments. |

| PayHippo | Nigeria | SME credit provider launching health-sector products. |

| Qhala | Kenya | Innovation studio digitizing insurer workflows. |

| Seguros Bolívar | Colombia | Major insurer backing health-tech collaborations. |

4️⃣ Diagnostics & Imaging AI

Localizing advanced diagnostics for low-resource settings.

| Startup | Country | Description |

|---|---|---|

| Dasa | Brazil | Largest diagnostics group in LATAM investing in AI imaging. |

| 54gene | Nigeria | Genomics & precision-medicine company building African biobank data. |

| InstaDeep Health | Tunisia / UK | AI modeling for clinical & logistics optimization. |

| Qure.ai | India → Africa | CE-cleared imaging-AI deployed across 15 African hospitals. |

| Pathotrak | South Africa | Automated pathology result management. |

| iSono Health | US → LATAM | Portable breast-ultrasound AI device. |

| Envisionit Deep AI | South Africa | Radiology triage and TB-screening AI system. |

| Medo AI | Canada → Kenya | Ultrasound-AI assisting non-specialists. |

| Curacel Health | Nigeria | AI fraud-detection and claim-automation for diagnostics. |

| Voxel AI | Kenya | Early-stage imaging-AI for chest X-rays. |

| Clinify Africa | Ghana | Data platform connecting labs and AI analytics. |

5️⃣ Digital Wellness & Mental Health

Localized therapy, mindfulness, and behavioral-health support.

| Startup | Country | Description |

|---|---|---|

| Yana | Mexico | Spanish-language mental-health chatbot with 12 M users. |

| Cuéntame | Mexico / LATAM | Corporate mental-health benefits platform. |

| Pura Mente | Argentina | Meditation and sleep app for Spanish speakers. |

| Wazi | Kenya | Online therapy & coaching for African markets. |

| Shezlong | Egypt | Arabic tele-therapy platform operating across MENA/Africa. |

| Inuka | Kenya / Netherlands | Coaching-based digital mental-health program. |

| Eleos Health | Global AI | AI-powered behavioral-therapy note-taking expanding to emerging markets. |

| MindFi | Singapore → Africa pilot | Corporate wellness & mindfulness app. |

| UpMind | Brazil | Online CBT-based therapy app. |

| Kult | LATAM | Lifestyle + wellness community integrating mental-health content. |

| Therapify | LATAM | Therapist-matching and digital-session marketplace. |

| Mente Sana App | Peru | Spanish wellness app for stress and anxiety management. |

6️⃣ Investors & Ecosystem Builders

The networks financing and accelerating regional healthtech.

| Organization | Region | Role |

|---|---|---|

| Flat6Labs Health | Africa / MENA | Accelerator investing in early-stage healthtech. |

| Endeavor Health LATAM | LATAM | Scale-up network for high-impact founders. |

| HealthTech Hub Africa | Rwanda / Pan-Africa | Public-private innovation accelerator. |

| Seedstars | Global Emerging Markets | Seed-stage investor & growth program. |

| Startup Chile | Chile | Government-backed accelerator for tech startups. |

| Google for Startups Africa | Pan-Africa | Mentorship, cloud credits & exposure for startups. |

| IFC Ventures | Global Emerging Markets | Health investment arm of the World Bank Group. |

| AfricArena | South Africa | Conference + deal-making platform for investors. |

| Health Innovation Exchange (UNDP) | Global | Connects innovators with ministries and donors. |

| Orange Ventures | Africa / Europe | Corporate VC investing in digital inclusion. |

| AXIAN Ventures | Mauritius / Africa | Impact investor funding health and fintech. |

| GrowthVybz | Global → Emerging Markets | Strategic partner providing GTM, research & ROI dashboards. |

Emerging-Market Entry ROI & Readiness Calculator

Estimate pilot ROI in LATAM or Africa and get a readiness score. Change any default—everything updates instantly.

Defaults reflect typical early pilots with a distribution partner. Tune to match your model.

≥70% = pilot-ready • 40–69% = fix gaps • <40% = discovery needed

merging-Market Entry Framework (6 Steps)

Use this as the backbone of your blog + CTA. Each step maps to a mini-deliverable you can sell.

-

Market Fit Scan (Week 0–1)

-

Validate demand, regulation “friendliness,” and partner density in 3 short-listed countries.

-

Deliverable: 1-page scorecard per country (fit, friction, fast lanes).

-

-

Partner Map (Week 1–2)

-

Identify 25–40 potential partners: payers/insurers, hospitals, telehealth platforms, accelerators, distributors.

-

Deliverable: Contactable partner list + warm intro angles.

-

-

Localization & Compliance (Week 2–3)

-

Language/culture adaptation, consent/DP laws, device or app classification, clinical safety notes.

-

Deliverable: “Go/No-Go” compliance checklist + copy/UX localization kit.

-

-

Pilot Design (Week 3–4)

-

90-day pilot with one distribution partner; define target cohorts, outcomes, and commercial model.

-

Deliverable: Pilot brief (targets, KPIs, responsibilities, data plan).

-

-

GTM & Ops Setup (Week 4–6)

-

Message testing, WhatsApp/LinkedIn outreach scripts, landing page, funnels, dashboards.

-

Deliverable: 30-day sprint plan + ROI dashboard (CAC, CPQL, MRR, Payback).

-

-

Scale & Funding (Week 6+)

-

Expand to city #2 or country #2; engage relevant funds/NGOs; negotiate payer deals.

-

Deliverable: Scale plan + investor/NGO intro list.

-

How GrowthVybz Helps

We turn your expansion idea into a measurable ROI plan.

From ecosystem research to partner outreach, regulatory checklists, and investor decks — GrowthVybz builds your go-to-market map for any region within 72 hours.