Digital therapeutics (DTx) represent a paradigm shift in healthcare: software-based, evidence-based interventions that treat medical conditions. But while innovation is booming, commercialization remains the biggest bottleneck — especially in Europe.

Getting to reimbursement is not optional; it’s essential for scaling, sustainability, and legitimacy. In Germany, the DiGA pathway provides a fast-track route, but most European markets lack such clarity. Founders often struggle to connect the dots: clinical validation → regulatory compliance → payer adoption → scalable distribution.

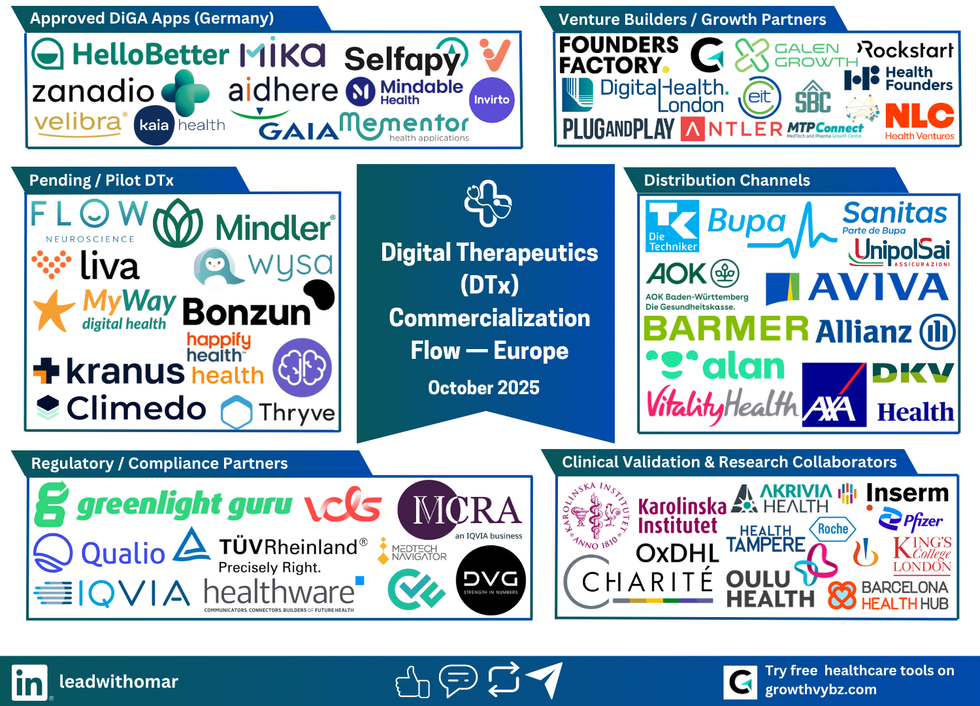

This blog post presents a 6-category framework to understand and navigate the DTx commercialization flow. Along the way, we spotlight real startups, enablers, and pitfalls you should know. Use it to craft your go-to-market strategy or to pitch sponsors, insurers, and investors with confidence.

The 6-Category Framework: Mapping the Digital Therapeutics (DTx) Commercialization Path

Building a successful digital therapeutic in Europe requires more than innovation — it demands orchestration.

A DTx startup must navigate six critical layers, each with its own success metrics, stakeholders, and pitfalls.

At GrowthVybz, we’ve developed a 6-Category Framework that maps this journey from proof-of-concept to full reimbursement and adoption.

Each layer represents a gate that determines whether your product moves forward or stalls.

Your advantage lies not just in excelling at one stage, but in bridging the handoffs — converting clinical data into regulatory approval, regulatory status into payer confidence, and payer confidence into commercial traction.

1️⃣ Approved DiGA Apps (Germany): Proof of Commercial Viability

Purpose:

These are the pioneers — apps that have achieved full reimbursement through Germany’s Digitale Gesundheitsanwendungen (DiGA) system. They serve as living benchmarks for efficacy, compliance, and patient engagement.

Why It Matters:

Being listed in the DiGA directory doesn’t just grant reimbursement; it establishes clinical credibility and market validation. These apps have survived the most rigorous combination of regulatory, clinical, and economic scrutiny in Europe.

Key Challenges:

-

Demonstrating real-world outcomes post-approval

-

Maintaining compliance with evolving DiGAV (Digital Healthcare Act) requirements

-

Educating clinicians and insurers to drive ongoing prescriptions and renewals

Examples:

-

HelloBetter – Evidence-based online psychotherapy for depression and anxiety, fully reimbursed under DiGA.

-

Kaia Health – Musculoskeletal and COPD digital therapies combining AI and behavioral science.

-

Zanadio – Clinically validated obesity therapy app enabling weight management through cognitive behavioral therapy.

-

Velibra – Mental-health DTx for anxiety disorders, developed by GAIA AG.

-

Selfapy – Guided CBT programs addressing stress, depression, and burnout, reimbursed by major German insurers.

-

Vivira – Digital musculoskeletal rehabilitation platform focused on home-based recovery and pain management.

Growth Insight:

Every market outside Germany is watching these case studies. Understanding their playbook — from trial design to insurer negotiation — is your fastest path to de-risking reimbursement.

2️⃣ Pending / Pilot DTx (UK, France, Nordics): The Scaling Innovators

Purpose:

These companies are the next wave — validated, clinically backed, and preparing to cross from pilot studies into national reimbursement or insurer adoption.

Why It Matters:

This is where most founders stall. They’ve proven efficacy but haven’t cracked local payer engagement or regulatory harmonization. GrowthVybz identifies these “near-ready” innovators and helps them structure their reimbursement-entry strategy.

Key Challenges:

-

Securing pilot funding or clinical sponsorship

-

Translating evidence from one country into another’s regulatory framework

-

Navigating fragmented health systems with distinct approval pathways

Examples:

-

Flow Neuroscience (Sweden) – CE-certified tDCS device and app for treating depression.

-

Mindler (Sweden) – Digital therapy platform integrating tele-psychology and CBT.

-

Liva Healthcare (Denmark) – Chronic-disease management and lifestyle coaching platform.

-

Wysa (UK/India) – AI-driven mental-health chatbot with clinical-grade outcomes data.

-

Cognitive+ (UK) – Cognitive training and neuro-rehabilitation DTx.

-

Bonzun (Sweden) – Digital maternal health and wellness platform with clinical guidance.

Growth Insight:

Founders in this group benefit from a “commercial readiness sprint” — a structured 72-hour roadmap that defines regulatory alignment, local reimbursement targets, and insurer partnership sequences.

3️⃣ Regulatory & Compliance Partners: The Invisible Infrastructure

Purpose:

No DTx can scale without compliance. This layer includes the consultancies, notified bodies, and software providers that make regulatory approval possible.

Why It Matters:

CE marking under MDR, DiGA submissions, and GDPR compliance are no longer checkboxes — they’re competitive differentiators. Investors, hospitals, and insurers all assess regulatory maturity before signing deals.

Key Challenges:

-

Selecting the correct device classification (often borderline for DTx)

-

Building and maintaining audit-ready quality systems (QMS)

-

Aligning cybersecurity and data privacy with EU and national frameworks

Examples:

-

DVG Experts – Specializes in Germany’s Digital Health Act and DiGA processes.

-

IQVIA – Regulatory and clinical services powerhouse supporting digital-health trials and filings.

-

Greenlight Guru – QMS software tailored for medical device and DTx developers.

-

Qualio – Cloud-based QMS helping startups accelerate CE readiness.

-

TÜV Rheinland – Global certification body performing conformity assessments for medical devices.

-

MedTech Navigator – Platform connecting healthtechs to regulatory advisors and clinical validation partners.

Growth Insight:

The smartest founders integrate regulatory workflows early — embedding documentation and risk controls into the product lifecycle, not retrofitting them at launch.

4️⃣ Clinical Validation & Research Collaborators: The Evidence Engine

Purpose:

Academic and healthcare partners generate the clinical evidence that drives payer confidence. Without strong validation, even the best DTx cannot justify reimbursement.

Why It Matters:

Insurers demand proof that a digital therapeutic is not only safe but cost-effective. Partnering with credible research institutions accelerates that process.

Key Challenges:

-

Designing trials acceptable to payers and regulators

-

Managing recruitment and adherence

-

Building data infrastructure for continuous evidence generation (RWE)

Examples:

-

Karolinska Institute (Sweden) – Global leader in clinical research for digital health.

-

Charité Berlin (Germany) – Running multiple DTx validation studies in neurology and mental health.

-

Oxford Digital Health (UK) – Academic group focused on digital health efficacy and outcomes.

-

INSERM (France) – French national research institute conducting DTx-focused trials.

-

Roche Digital – Collaborating with startups on AI-driven diagnostics and therapeutics.

Growth Insight:

Your validation partner determines your reimbursement probability. Select a collaborator recognized by payers in your target geography — it can halve your approval time.

5️⃣ Distribution Channels (Insurers & Employers): The Commercial Gatekeepers

Purpose:

These organizations decide whether your digital therapeutic gets paid for — through reimbursement, prescription, or inclusion in corporate health plans.

Why It Matters:

After regulatory approval, reimbursement and distribution determine survival. Convincing insurers requires translating clinical outcomes into economic ROI: cost savings, reduced readmissions, or higher productivity.

Key Challenges:

-

Quantifying ROI for payers and employers

-

Navigating lengthy procurement or tender processes

-

Managing clinical adoption among physicians and care networks

Examples:

-

TK, AOK, BARMER – Germany’s major statutory insurers actively adopting DiGA.

-

Alan – French digital insurer integrating preventive digital therapies.

-

Vitality, Bupa, Aviva – UK insurers linking wellness programs with reimbursable digital tools.

-

Allianz, DKV, Sanitas – Multinational payers exploring chronic-care DTx integration.

Growth Insight:

Your success hinges on converting evidence into economics. Build a one-page payer ROI summary — quantify outcomes, and make the cost–benefit impossible to ignore.

6️⃣ Venture Builders & Growth Partners: The Acceleration Layer

Purpose:

Even with regulatory approval and payer interest, scaling a DTx requires strategic partnerships — venture builders, accelerators, and commercialization specialists that understand health-market entry.

Why It Matters:

Most DTx founders are clinicians or scientists, not growth strategists. This layer closes the go-to-market gap and creates a repeatable sales engine for health systems and employers.

Key Challenges:

-

Choosing the right growth partner for your stage

-

Balancing investor expectations with clinical integrity

-

Building international expansion strategies that align with reimbursement frameworks

Examples:

-

GrowthVybz – Custom commercialization systems for healthtechs; builds ROI-driven go-to-market maps and funding readiness sprints.

-

Founders Factory Health – UK accelerator connecting startups with corporates like GSK and Aviva.

-

EIT Health – EU innovation network providing grants, mentorship, and market access.

-

Plug & Play Health – International platform bridging DTx startups with global healthcare partners.

-

DigitalHealth.London – Helps innovators scale within NHS frameworks.

Growth Insight:

Venture builders transform validated products into marketable assets. Partner early, and you’ll compress years of trial-and-error into a structured commercialization sprint.

The “Clinical Growth Engine™”: Turning Validation Into Revenue

The biggest myth in digital therapeutics is that approval equals adoption.

Getting CE-marked or DiGA-listed is just the ticket to the race. The real competition begins when you must translate validation into commercial traction.

That’s where our proprietary framework — the Clinical Growth Engine™ — comes in.

It’s not a marketing campaign or a funnel. It’s a structured growth architecture that links your clinical credibility to commercial momentum.

It operates on three connected pillars:

DTx Commercialization Estimator

Quickly estimate **revenue, payer savings, break-even, and readiness**. For a payer-grade model, email us from the button below.

1️⃣ Market Activation Layer — Turning Proof into Visibility

Most DTx companies spend 80% of their energy on validation but less than 5% on visibility.

The GrowthVybz system identifies high-intent buyer segments (insurers, health systems, pharma alliances) and activates them through a precision content loop — strategic case stories, regulatory milestones, and ROI visuals placed where decision-makers actually engage.

Think of it as your “evidence-to-awareness pipeline.”

-

Publish → Repurpose → Re-target → Syndicate

-

Data-backed storytelling replaces generic outreach.

-

Each asset links to one clear call-to-action: “Partner, Pilot, or Prescribe.”

2️⃣ Conversion Layer — Orchestrated Partner Journeys

Once awareness starts compounding, most DTx founders face a new gap: fragmented outreach.

We close that gap through the GrowthVybz Conversion Web™ — a structured ecosystem of personalized touchpoints that convert institutional interest into strategic calls and pilots.

Instead of cold emails or random conference pitches, every contact point (LinkedIn insight post, ecosystem map inclusion, ROI calculator tool, or partner webinar) is mapped to a defined progression path.

Each touchpoint is scored on three outcomes: Trust, Data Exchange, and Invitation to Collaborate.

This system quietly nurtures insurer, accelerator, and investor leads until they’re ready for contractual engagement.

3️⃣ Scalability Layer — Embedded Lead Systems

While pilots generate traction, sustained growth demands automation.

That’s why we build embedded lead systems into our clients’ websites and microsites — not visible to competitors, but powerful enough to continuously attract inbound opportunities.

Behind every GrowthVybz project lies a network of integrated components:

-

Custom lead magnets (ROI calculators, readiness scorecards, reimbursement simulators)

-

Intelligent outreach triggers (AI chat workflows, value-based follow-ups)

-

Private dashboards connecting web analytics to decision-maker engagement

These assets don’t just “collect emails.”

They quantify intent — highlighting which investors, insurers, or pharma partners are interacting with your content in real time.

💡 Why It Works

The Clinical Growth Engine™ is designed for one purpose:

To turn your validated product into a revenue-ready brand — without wasting six months on guesswork or cold marketing.

Our clients use it to:

-

Shorten time-to-commercialization by up to 40%

-

Secure insurer meetings within 30 days post-approval

-

Build investor and partner deal flow through inbound credibility rather than outbound noise

⚡ Key Takeaway for Founders

If your DTx has proven efficacy but not predictable revenue, you don’t need more trials — you need traction infrastructure.

That’s what we quietly build behind every ecosystem map and commercial sprint:

an evidence-driven, compliance-safe system that attracts partners while you focus on patients.

DM “ENGINE” or visit growthvybz.com/dtx-engine to request a private breakdown of how this system could apply to your DTx company.