Utah's healthcare startup ecosystem has quietly matured into one of the most resilient and revenue-focused hubs in North America. It's not just quantity—it's impact. Here's why:

-

📍 Strategic Location: Proximity to Intermountain Health and the University of Utah creates a built-in clinical innovation loop.

-

👩⚕️ Workforce Density: High concentration of biotech engineers, regulatory experts, and med device talent.

-

🧪 Lab-to-Market Infrastructure: Access to rapid FDA pathways, pilot-ready systems, and contract research partners like Nelson Labs.

-

💰 ROI Focus: Utah startups are less "demo deck" and more “deployment-ready” — high user adoption, clinical partnerships, and funding momentum.

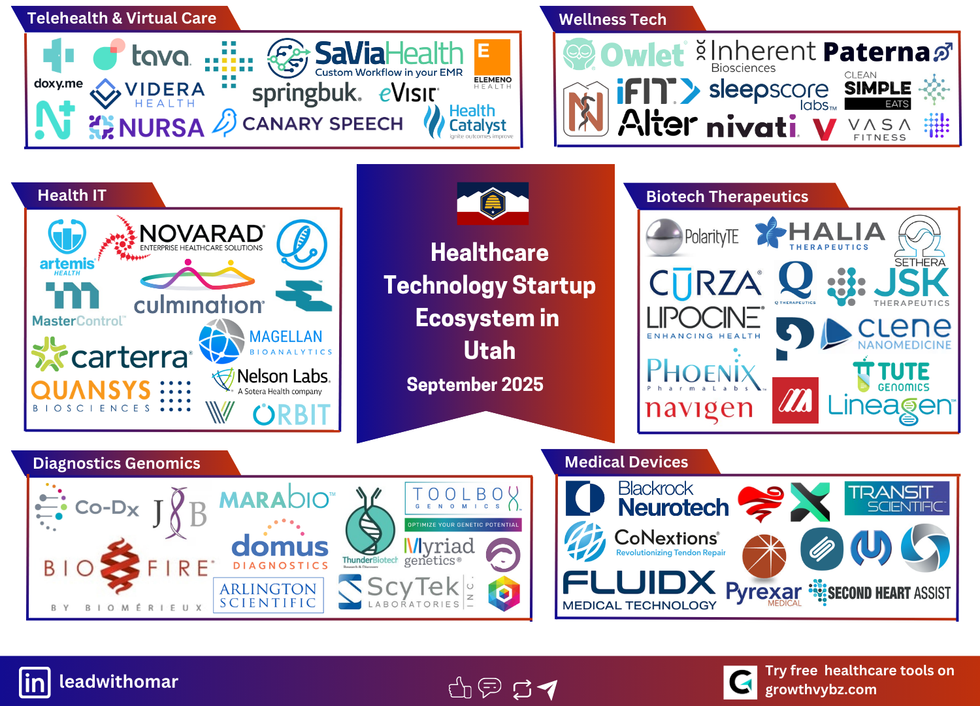

🔬 Market Map: 6 Startup Categories Powering Utah's 2025 HealthTech Boom

1. Telehealth & Virtual Care

Solving rural access and care continuity with real-time solutions.

Key Players:

-

Tava Health: Teletherapy for employees with employer partnerships.

-

Doxy.me: Global telemedicine platform simplifying clinical video visits.

-

Canary Speech: Voice biomarkers for remote mood and neurological screening.

-

SaVia Health: Custom care workflows inside EMRs for providers.

-

Videra Health: Video-based mental health triage.

✅ Why it works: Integration with employer benefits, EMRs, and payer networks. Fast adoption due to Utah's spread-out geography and underserved rural zones.

2. Health IT & Workflow

Boosting provider efficiency, compliance, and data intelligence.

Key Players:

-

Novarad: Imaging software + surgical AR guidance.

-

Carterra: Label-free antibody screening platform.

-

MasterControl: Regulated quality management for clinical labs.

-

Health Catalyst: Data analytics driving population health improvements.

-

Culmination Bio: Massive biobank data monetization with providers.

✅ Why it works: These startups build for backend ops, not front-end flair. Value is proven in cost savings + interoperability with Epic, Cerner, etc.

3. Wellness Tech

Preventive care that scales—from fertility to fitness.

Key Players:

-

Owlet: Infant health monitoring with FDA-cleared sock.

-

iFIT: Connected fitness platform with content & wearables.

-

Inherent Biosciences: Sperm diagnostics via epigenetics.

-

Paterna: Hormonal tracking + fertility insights.

-

Nivati: Mental wellness platform for employers.

✅ Why it works: DTC-to-B2B pivot success. Wellness companies are now selling into self-insured employers and insurers to reach scale.

4. Diagnostics & Genomics

Fast, accurate, and portable screening solutions.

Key Players:

-

BioFire (bioMérieux): Infectious disease diagnostics platform.

-

Marabio: Novel multiplex PCR systems.

-

Co-Dx: At-home molecular testing kits.

-

Domus Diagnostics: Rapid point-of-care flu and COVID tests.

-

Toolbox Genomics: DNA-based nutrition and fitness plans.

✅ Why it works: Utah firms build for speed + regulation. CLIA compliance, FDA focus, and global distribution in place from early stages.

5. Medical Devices

From brain implants to vascular support systems.

Key Players:

-

Blackrock Neurotech: Brain-computer interface company—FDA breakthrough device.

-

Second Heart Assist: Percutaneous mechanical circulatory support.

-

Pyrexar Medical: Cancer treatment via thermal therapy.

-

CoNextions: Tendon repair with faster healing.

-

FLUIDX: Minimally invasive drainage systems.

✅ Why it works: Clinical partnerships with Intermountain + University of Utah Hospital. Early human trials and regulatory guidance are core.

6. Biotech Therapeutics

Therapies pushing the edge of immune modulation and cell-level repair.

Key Players:

-

Curza: Novel antibiotics for resistant pathogens.

-

Halia Therapeutics: Inflammatory pathway blockers.

-

Lipocine: Oral hormone therapeutics.

-

Sethera: Immune-enhancing antivirals.

-

Lineagen: Genetic diagnostics for neurodevelopmental disorders.

✅ Why it works: Utah biotech excels in translational science—spinning out from university research directly into funded startups.

🔁 Framework for Startup Traction in Utah (2025)

Whether you're building a health SaaS, diagnostics platform, or digital care tool, here's the playbook:

-

Start with health system co-design → Intermountain, U of U, SelectHealth

-

Local proof + payer validation → Don’t skip CPT, Medicaid coverage, or IRB approvals

-

Go beyond D2C → B2B2C models with employers, clinics, and urgent care chains

-

Lead with compliance → CE/FDA + SOC2 + ISO13485 early

-

Fund from strategic angels → Utah-centric investors prefer capital-efficient, regulated models

💡 How GrowthVybz Helps

At GrowthVybz, we’ve helped 500+ startups grow across clinical and consumer healthcare:

🔍 Market Research: Competitor landscape, buyer personas, ICP

🧠 GTM Strategy: Payer/provider/enterprise funnels—not just D2C

📩 Lead Gen Systems: 1000+ verified leads/month from providers, investors, or partners

📈 Fundraising Support: Decks, investor targeting, and narrative positioning

🧰 Tools: ROI calculators, API-ready widgets, and content kits for pilots or accelerators

📩 Ready to grow your Utah-based HealthTech startup—or tap into the ecosystem?

Let’s co-build your market map, GTM engine, or B2B growth funnel.

Explore free tools or schedule a consult at 👉 www.growthvybz.com

Disclaimer:

All company names, logos, and trademarks are the property of their respective owners. Inclusion in this market map is for informational and educational purposes only and does not imply any partnership, endorsement, or affiliation with GrowthVybz.

The information provided is based on publicly available sources (such as company websites, press releases, and industry reports) and is believed to be accurate at the time of publication. GrowthVybz makes no representations or warranties regarding completeness or accuracy, and accepts no liability for any errors or omissions.

This market map is an independent analysis created by GrowthVybz. It is not intended as investment advice or solicitation. Companies listed here are welcome to contact us to update or correct their information.

Note: GrowthVybz offers separate marketing, fundraising, and growth services. These services are independent offerings and are not endorsed or sponsored by the companies featured in this map.