📊 By 2025, over $70 billion worth of healthcare data will be traded annually — yet fewer than 6% of startups actually monetize their own data.

Hospitals, healthtech startups, and AI firms are generating oceans of valuable data — patient outcomes, imaging, genomics, claims, wearables — but most of it sits idle behind compliance fears, legacy systems, and confusion about who owns what.

Meanwhile, a fast-growing group of data marketplaces, compliance engines, and evidence networks are quietly turning that same “unused” data into recurring revenue.

This isn’t a future forecast — it’s already happening across the U.S. and Europe.

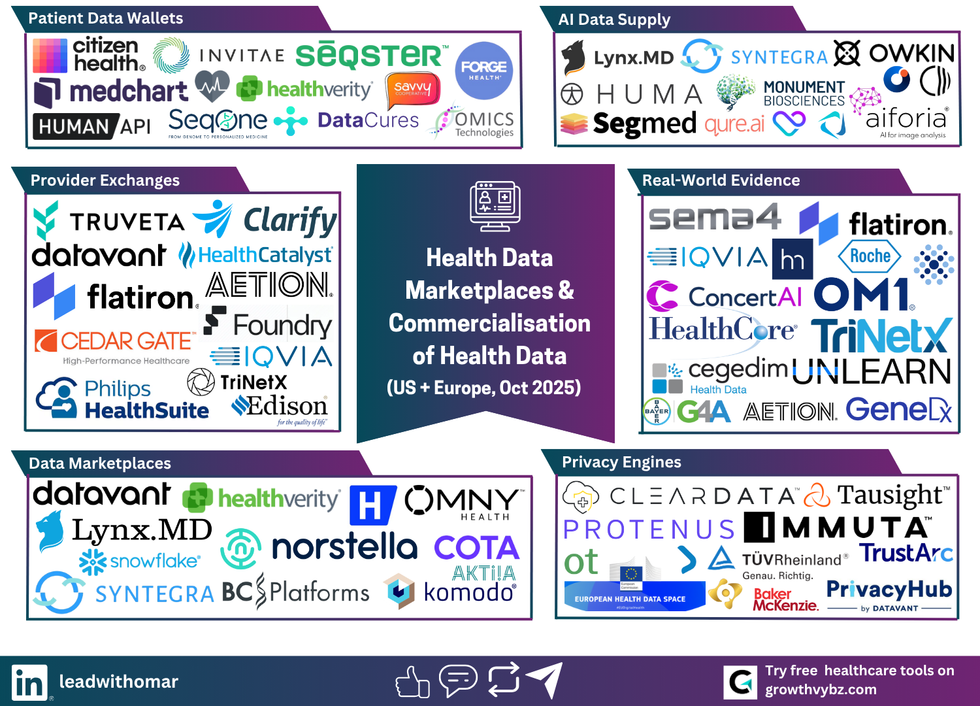

Below is a breakdown of the 6-layer Health Data Commercialization Stack, showing where the money flows, who controls it, and how founders, hospitals, and innovators can finally plug in.

1️⃣ Patient Data Wallets — Turning Ownership into Opportunity

For decades, patients have been the source of healthcare data — but never the owners.

That’s changing fast.

Platforms like Citizen Health, Seqster, and Savvy Cooperative are pioneering a new model: users can now collect their electronic health records, genomics, and wearable metrics into secure “data vaults.” These platforms let individuals choose who can access their data and even earn compensation when they share it for research, clinical trials, or drug development.

Platforms giving individuals control, portability, and monetization of their medical data.

| Company | Description |

|---|---|

| Citizen Health (US) | Patient-owned data vaults that let users control and monetize their medical records. |

| Seqster (US) | Unified “health passport” aggregating EMR, genomics, and wearable data under patient control. |

| Savvy Cooperative (US) | Patient-owned cooperative that compensates members for sharing lived-experience data. |

| Medchart (US) | Enables consumer-authorized release of medical records for research and legal use. |

| HealthVerity Consent (US) | Manages patient-level consent tracking and authorization across multiple datasets. |

| Human API (US) | Connects patient-authorized health data directly to insurers and digital-health partners. |

| SeqOne (France) | Patient-mediated genomic-data platform supporting oncology and precision-medicine access. |

| Forge Health (EU) | Behavioral-health data-sharing app with explicit patient consent controls. |

| DataCures (EU) | Consent-as-a-service tool enabling rare-disease communities to collectively license data. |

| Omics Technologies (US) | Aggregates omics profiles and matches users with research or drug-development partners. |

This shift is profound — it’s not just about privacy. It’s about patients becoming stakeholders in the data economy.

💡 Framework for Growth

-

Transparent Consent: Use clear, granular opt-ins so users understand every data use case.

-

Value-Based Sharing: Offer equitable benefit sharing — monetary rewards, premium access, or community funding.

-

Payment Integration: Implement smart contracts or tokenized rewards that automate payouts when data is used.

🧩 Your Role

If you’re building a healthtech startup or advocacy platform, this is where you convert trust into traction.

GrowthVybz helps founders design compliant user flows, communication systems, and growth messaging that transform patient communities into sustainable, ethical data networks — ready to partner with research and pharma organizations.

2️⃣ Provider Exchanges — Hospitals Monetizing Data, Safely

Hospitals and health systems are realizing that their biggest untapped asset isn’t equipment — it’s data.

Organizations like Truveta, Clarify Health, and TriNetX are leading this movement by pooling de-identified hospital data and licensing it to pharmaceutical companies for drug development, safety studies, and predictive analytics.

| Company | Description |

|---|---|

| Truveta (US) | Coalition of major U.S. health systems pooling anonymized patient data for research. |

| Clarify Health (US) | Converts claims and clinical data into cost- and outcomes-analytics products. |

| Datavant (US) | Provides tokenization and linkage infrastructure for privacy-safe data sharing. |

| Health Catalyst (US) | Data-warehouse and analytics platform helping hospitals monetize insights. |

| Aetion (US) | Generates regulatory-grade real-world evidence for payers and regulators. |

| Flatiron Health (US) | Oncology-focused EHR and outcomes dataset provider used by pharma. |

| Cedar Gate (US) | Offers value-based-care analytics to payers and risk-bearing providers. |

| Palantir Foundry (US) | Integrates disparate hospital datasets for research and operational intelligence. |

| Philips HealthSuite (Netherlands) | Cloud platform federating imaging and device telemetry data for analysis. |

| IQVIA (Global) | Connects provider and pharma partners through its global clinical-data network. |

| TriNetX (Global) | Enables hospitals to share anonymized cohort data for clinical-trial feasibility. |

| GE HealthCare Edison (US) | Combines imaging and workflow data into analytics products for hospitals. |

It’s a win-win: hospitals gain a new revenue stream, and the medical community accelerates research with cleaner, real-world datasets.

💡 Framework for Growth

-

Identify Valuable Assets: Focus on non-sensitive yet insight-rich datasets — imaging, outcomes, patient flow.

-

Tokenize & Standardize: Use integration layers like Datavant or Palantir Foundry to make data shareable and traceable.

-

Build Ethical Partnerships: Create clear governance models and transparent data-sharing contracts.

🧩 Your Role

Hospitals often struggle to bridge compliance, technical, and business goals.

That’s where GrowthVybz steps in — crafting monetization frameworks, partner decks, and ROI roadmaps so providers can safely commercialize de-identified data without risking trust or legal exposure.

3️⃣ Data Marketplaces — The Stock Exchanges of Health Data

Imagine a NASDAQ — but for medical datasets.

That’s exactly what’s emerging with platforms like Datavant Marketplace, OMNY Health, and Komodo Health, which enable B2B trading of de-identified health data between hospitals, insurers, and AI developers.

| Company | Description |

|---|---|

| Datavant Marketplace (US) | Central exchange for tokenized clinical, claims, and lab datasets. |

| HealthVerity Exchange (US) | Real-world-data marketplace mixing clinical and consumer datasets. |

| OMNY Health (US) | Lets hospitals license de-identified data directly to life-science partners. |

| Komodo Health (US) | Provides patient-journey intelligence built from U.S. claims and outcomes data. |

| Norstella /MMIT (Global) | Aggregates access and outcomes data for market-access decisions. |

| Lynx.MD (US/IL) | Secure collaboration sandbox for healthcare institutions and AI developers. |

| Syntegra (US) | Creates statistically faithful synthetic patient datasets for safe sharing. |

| BC Platforms (Finland) | Biobank and genomic-data exchange connecting hospitals and pharma. |

| Snowflake Healthcare Cloud (US) | Enables governed data sharing and monetization within cloud environments. |

| Aktiia (Switzerland) | Provides anonymized wearable cardiovascular datasets for research licensing. |

| COTA Healthcare (US) | Structures oncology data for evidence generation and value-based contracting. |

These ecosystems thrive on data quality, traceability, and compliance — buyers want structured, labeled, and standardized data they can plug into analytics or model training instantly.

💡 Framework for Growth

-

Clean & Label: Ensure all datasets are standardized, anonymized, and analytics-ready.

-

List in the Right Marketplace: Choose the best-fit exchange (Datavant, BC Platforms, Snowflake Health).

-

License Smartly: Adopt recurring or usage-based pricing models to maximize ongoing revenue.

🧩 Your Role

GrowthVybz helps you identify where your dataset fits, how to price it, and which buyers are most active — turning idle data into recurring revenue without compromising compliance.

4️⃣ Privacy Engines — Compliance as a Competitive Edge

In 2025, data privacy isn’t a hurdle — it’s the entry ticket to the market.

With the EU Health Data Space (EHDS) rolling out and U.S. states tightening privacy laws, compliance frameworks are now the foundation for trust — and for profit.

Platforms like ClearDATA, Immuta, and OneTrust Health make it possible for startups and hospitals to safely share data while maintaining HIPAA and GDPR compliance.

| Company | Description |

|---|---|

| ClearDATA (US) | Cloud-governance platform ensuring HIPAA/GDPR compliance for healthcare data. |

| Protenus (US) | Privacy-monitoring and access-audit software for hospitals and health systems. |

| Tausight (US) | Detects and manages PHI exposure across endpoints in real time. |

| Immuta (US) | Policy-based data-access control and masking for analytics teams. |

| OneTrust Health (US) | Consent and data-rights management aligned with U.S. state privacy laws. |

| TrustArc Health (US) | Automates multi-state privacy and HIPAA compliance programs. |

| TÜV Rheinland (Germany) | Certifies digital-health and data-use compliance across EU markets. |

| Baker McKenzie (Global) | Legal advisory on cross-border data commercialization and privacy. |

| European Health Data Space (EU) | EU-wide regulatory framework enabling secondary use of health data. |

| PrivacyHub (by Datavant) | Centralized de-identification and compliance platform for dataset sharing. |

💡 Framework for Growth

-

Privacy-by-Design: Integrate security from day one — not as an afterthought.

-

Consent APIs: Automate user control and withdrawal processes.

-

Audit Everything: Build transparency reports that strengthen investor and partner trust.

🧩 Your Role

Instead of fearing regulation, leverage it as your trust moat.

GrowthVybz designs data-sharing frameworks and legal-safe storytelling that help founders and innovation teams move faster, close more B2B deals, and stay compliant across borders.

5️⃣ Real-World Evidence — From Data to Decision

When health data becomes proof — it turns into Real-World Evidence (RWE).

Companies like Aetion, Flatiron Health, and OM1 package longitudinal patient data into insights used by the FDA, EMA, and payers to validate new therapies or support reimbursement models.

| Company | Description |

|---|---|

| Sema4 / GeneDx (US) | Genomic and phenotypic-data network supporting precision-medicine evidence. |

| IQVIA RWE (Global) | Global provider of longitudinal real-world datasets and analytics. |

| Flatiron Health (US) | Oncology evidence platform used by regulators and life-science firms. |

| Roche (EU) | Pharma leader using partnered data networks for RWE and clinical validation. |

| ConcertAI (US) | AI-driven oncology RWE generation platform. |

| HealthCore (US) | Payer-based evidence network generating outcomes insights for reimbursement. |

| OM1 (US) | Specialty-disease registries producing real-world outcomes evidence. |

| TriNetX Analytics (Global) | Provides cohort analytics and trial-feasibility data to sponsors. |

| Cegedim Health Data (France) | Primary-care RWE datasets used for market-access dossiers. |

| Unlearn.AI (US) | Builds “digital-twin” control arms to accelerate clinical-trial approvals. |

| Bayer G4A (EU) | Pharma venture program commercializing digital-health evidence partnerships. |

| Aetion RWE (US) | Analyzes real-world outcomes for regulatory and payer decision-making. |

This is where raw data becomes regulatory gold — each insight directly influences how healthcare products reach patients.

💡 Framework for Growth

-

Aggregate Patient Journeys: Connect claims, EMR, and outcome data.

-

Align to RWE Guidance: Follow FDA/EMA frameworks for credibility.

-

Visualize Insights: Create dashboards and narratives that prove measurable impact.

🧩 Your Role

Most startups already collect outcomes data — they just don’t position it as evidence.

GrowthVybz turns that data into a pharma-ready story that commands partnership, validation, and funding.

🤖 6️⃣ AI Data Supply — Feeding the Next Generation of Models

AI in healthcare lives and dies by data quality.

Startups like Owkin, Lynx.MD, and Syntegra are reshaping how hospitals, labs, and developers share training data without ever moving raw files.

| Company | Description |

|---|---|

| Lynx.MD (US/IL) | Secure hospital sandbox enabling AI training on de-identified data. |

| Syntegra (US) | Generates synthetic healthcare datasets for model development. |

| Owkin (France/US) | Uses federated learning to train AI models across European hospitals. |

| Huma (UK) | Converts wearable and remote-monitoring data into structured model inputs. |

| Segmed (US) | Curated, anonymized medical-imaging libraries for AI developers. |

| Monument Biosciences (US) | Provides microbiome and metabolic datasets for AI drug discovery. |

| Qure.ai (India/US) | Supplies labeled imaging data for radiology and chest-X-ray AI. |

| Aiforia (Finland) | Pathology-image AI company training models on digitized slides. |

| Aidoc (Israel/US) | Acute-care imaging-AI firm leveraging anonymized clinical data streams. |

| HeartFlow (US) | Uses CT-derived coronary datasets for 3D modeling and AI validation. |

| Kheiron Medical (UK/US) | Breast-cancer screening AI trained on multi-country mammography data. |

| Corti (Denmark/US) | Voice-AI company using emergency-call data for triage algorithms. |

Through federated learning, synthetic data, and secure sandboxes, they create scalable ways to train models safely — while monetizing de-identified datasets.

💡 Framework for Growth

-

Curate & Annotate: Structured, labeled data drives the highest model value.

-

Federate or Simulate: Train AI where data lives (no transfers).

-

Monetize via APIs: Offer access to insights, not files — recurring revenue without data exposure.

🧩 Your Role

Whether you manage hospital imaging, device data, or research datasets, GrowthVybz can help you package and price your training data for ethical, high-value AI partnerships.

💡 Estimate Your Health Data Revenue Potential

This calculator estimates compliant partnership value — not “selling raw PHI.” You’ll also get a ready-to-send email draft to request the 48h Data Value Sprint (€2,000).

💡 How the Interactive “Data Revenue Check” Tool Works

Just below this article, you’ll find the Health Data Revenue Check — a mini interactive tool built by GrowthVybz.

It’s not just a form — it’s a personalized data monetization diagnostic.

Here’s what it does:

-

Segments your position — You choose what type of data you control (e.g. provider data, RWE, AI datasets).

-

Clarifies your goal — Monetization, compliance, partner intros, or narrative building.

-

Shows your opportunity — It instantly generates a tailored insight on how to turn your data into revenue within 48 hours.

-

Captures warm leads — By requesting your personalized “48h Sprint,” you book a private €2 000 consultation where we build your monetization roadmap, buyer list, and compliance plan.

The widget blends storytelling, qualification, and CTA — so instead of a passive “contact form,” it feels like a data audit conversation.

And that’s the difference between traffic and conversion.

🚀 Next Step

If you’re sitting on patient records, imaging data, wearable streams, or real-world outcomes, you’re already sitting on a monetizable asset.

The only thing missing is the framework.

👉 Use the Data Revenue Check Tool below, or DM “DATA” on LinkedIn — and I’ll show you exactly how to turn your existing datasets into compliant, recurring revenue streams in 48 hours.