Every month, the average healthtech founder burns €2,700 chasing pilots and “visibility”—yet still struggles to convert those into paying clients.

Why? Because Europe’s healthtech ecosystem is fragmented. Founders jump between accelerators, cold emails, analytics dashboards, and investors, but rarely build an integrated Revenue Stack—a system that connects go-to-market, sales, data, distribution, and pricing intelligence.

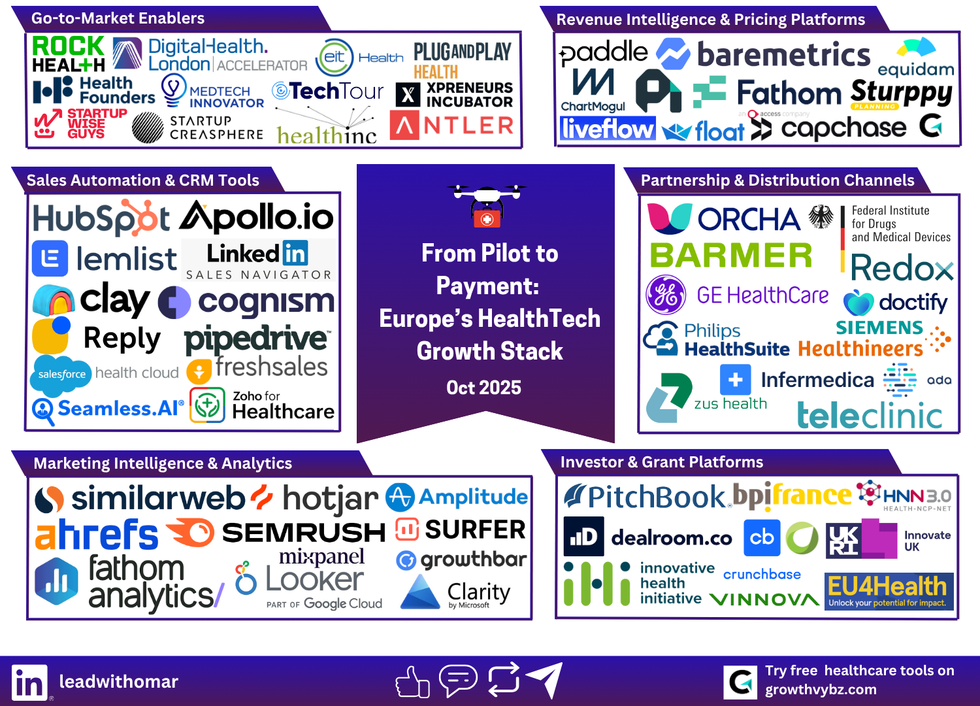

At GrowthVybz, we call this the “From Pilot to Payment Framework.”

It’s the blueprint we use to help startups shift from scattered activity to predictable growth.

This post breaks down that system, category by category—highlighting 72 companies that define the 2025 HealthTech revenue engine.

💡 The Opportunity

Europe’s HealthTech ecosystem raised over €5.3 billion in 2025, but only 20 % of startups report consistent commercial traction. Investors and accelerators now demand revenue visibility, LTV, and payer pathways—not just pilots.

👉 If you can show founders where they’re leaking revenue and how to plug it using this framework, you become their go-to growth partner.

Each layer below is an entry point for consulting, GTM optimization, or data-driven audit offers (€1 500–€2 000 per client).

⚙️ The 6 Layers of Europe’s HealthTech Growth Stack

1️⃣ Go-to-Market Enablers

These programs connect innovators to investors, hospitals, and payers—the launchpads where scalable startups begin.

| Platform | What They Do |

|---|---|

| Rock Health | A full-service digital-health fund and strategy group, providing data, insight, and capital. |

| DigitalHealth.London Accelerator | NHS-linked program accelerating commercialization and procurement readiness. |

| EIT Health | Europe’s largest health innovation network with funding and training. |

| Plug and Play Health (Europe/UK) | Connects startups to pharma, insurers, and medtech giants for pilot projects. |

| Health Founders | Baltic and Nordic accelerator offering GTM mentorship and seed support. |

| HealthInc (Amsterdam) | Accelerator focusing on hospital innovation pilots. |

| MedTech Innovator (EU/APAC) | Large medtech scale-up platform and global roadshow. |

| Startup Wise Guys (Health/B2B) | B2B accelerator focused on building commercial traction. |

| Startup Creasphere | Munich-based corporate accelerator backed by Roche and Plug & Play. |

| Tech Tour Health | Investor and scale-up matchmaking network across Europe. |

| Founders Factory Health | UK-based venture builder offering capital and GTM support. |

| Antler Health | Global venture builder supporting early-stage health founders. |

🧩 Why it matters:

These networks don’t just mentor—they generate partnerships and pilots that can be monetized. GrowthVybz helps founders extract ROI from these ecosystems by measuring leads, conversions, and funding results.

2️⃣ Sales Automation & CRM Tools

The stack that turns relationships into revenue.

| Tool | Use Case |

|---|---|

| HubSpot | CRM + inbound marketing hub for scaling startups. |

| Apollo.io | Sales prospecting and multichannel outreach automation. |

| lemlist | Personalized cold-email and LinkedIn sequencing. |

| Clay | AI-driven lead research and trigger-based targeting. |

| Cognism | GDPR-compliant contact-data platform strong in EU markets. |

| LinkedIn Sales Navigator | Core ICP targeting tool for healthtech sales teams. |

| Reply.io | Sequence automation and inbox management. |

| Pipedrive | Simple CRM pipeline tool for small teams. |

| Salesforce Health Cloud | Enterprise CRM connecting to EHR and payer systems. |

| Freshsales | Lightweight CRM with built-in calling for early teams. |

| Zoho CRM | Budget CRM used widely by EU seed-stage startups. |

| Seamless.ai | AI-powered contact discovery and enrichment. |

🧩 How GrowthVybz helps:

We integrate CRM data with marketing KPIs to show Cost per Qualified Lead (CPQL) and ROI per outreach channel, turning random outreach into measurable pipelines.

3️⃣ Marketing Intelligence & Analytics

You can’t scale what you can’t measure. These tools quantify traffic, conversion, and user behavior.

| Tool | Strength |

|---|---|

| Similarweb | Web traffic and market benchmarking. |

| Ahrefs | SEO + backlink intelligence for organic growth. |

| Semrush | Complete marketing suite (SEO/PPC/content). |

| Hotjar | Heatmaps and behavior analytics for conversion optimization. |

| Databox | Multi-channel dashboards for performance tracking. |

| Fathom Analytics | Privacy-first, GDPR-safe web analytics. |

| Looker Studio | Free dashboarding for startup reporting. |

| Amplitude | Product analytics for activation and retention. |

| Microsoft Clarity | Session replays and user-flow tracking. |

| SurferSEO | AI-driven content optimization. |

| GrowthBar | Quick content briefs for SEO landing pages. |

| Mixpanel | Product-usage analytics for data-driven decisions. |

🧩 How GrowthVybz helps:

We merge analytics dashboards into an ROI cockpit—visualizing CPL, CPQL, and ARR growth. Clients get clear visibility into what channel drives actual revenue.

4️⃣ Investor & Grant Platforms

Access to capital defines scale velocity. These platforms unlock equity, grants, and partnerships.

| Platform | Scope |

|---|---|

| PitchBook | Private-market data, valuations, and benchmarks. |

| Dealroom | Europe-focused ecosystem mapping. |

| Crunchbase | Global funding database and startup tracker. |

| AngelList | Early-stage investment and syndicates. |

| Horizon Europe (Cluster 1) | EU’s flagship health innovation program. |

| HaDEA Health Calls | Central EU agency managing grant disbursements. |

| Innovate UK | UK grants and accelerator support. |

| Vinnova | Sweden’s innovation fund for healthtech. |

| Bpifrance | France’s state-backed investment bank. |

| Seedrs | Equity-crowdfunding for early healthtechs. |

| EU Funding & Tenders Portal | Unified EU application interface. |

| Tech Tour / MedTech Strategist | Investor showcases for later-stage growth. |

🧩 How GrowthVybz helps:

We connect funding readiness to GTM metrics—aligning commercial traction with investor expectations.

5️⃣ Partnership & Distribution Channels

Without channels, innovation dies in pilot purgatory. These are the pipelines to patients, hospitals, and insurers.

| Partner | Description |

|---|---|

| ORCHA | App accreditation & NHS integration. |

| DiGA (BfArM) | German digital-therapy reimbursement system. |

| BARMER | German health insurer adopting digital care solutions. |

| Roche Partnering / Startup Creasphere | Pharma & provider pilot route. |

| GE HealthCare Digital | Hospital command-center and imaging platforms. |

| Philips HealthSuite | Cloud infrastructure for diagnostics & monitoring. |

| Siemens Healthineers Digital Ecosystem | Provider-tech network integration. |

| Redox | EHR/API integration middleware for startups. |

| Zus Health | Composable health-data layer for developers. |

| Infermedica | AI triage engine used by insurers & clinics. |

| Ada Health | Global AI symptom checker for consumer pathways. |

| TeleClinic | German telemedicine provider linking patients & payers. |

🧩 How GrowthVybz helps:

We build partnership funnels—matching healthtechs to insurers and provider networks, shortening time from pilot to payer contract.

6️⃣ Revenue Intelligence & Pricing Platforms

This layer transforms activity into predictable profit—data-driven pricing, forecasting, and capital access.

| Platform | Function |

|---|---|

| Paddle | Subscription billing & tax automation. |

| ProfitWell (by Paddle) | Retention and pricing analytics. |

| ChartMogul | Revenue cohort and MRR analytics. |

| Baremetrics | Growth dashboards for subscription businesses. |

| Price Intelligently | B2B SaaS pricing optimization. |

| FathomHQ | Financial KPI tracking & reporting. |

| Sturppy Finance | Automated financial modeling for investors. |

| LiveFlow | Real-time finance syncing with Sheets. |

| Float App | Cash-flow forecasting for startups. |

| Capchase | Non-dilutive revenue financing. |

| Arc Finance | Stripe-connected capital access. |

| Calqulate | European financial analytics & revenue visualization. |

| Equidam | Valuation modeling for fundraising. |

| Growblocks | 2025 Danish platform for B2B revenue intelligence. |

🧩 How GrowthVybz helps:

We unify commercial metrics (pipeline, pricing, cash flow) into one “Revenue Intelligence Dashboard,” showing founders exactly how to increase ARR by 20 %+.

The GrowthVybz “Pilot-to-Payment” Monetization Framework

Think of this as the operating system for turning a pilot-stage startup into a revenue machine.

Every founder and consultant who uses it learns to stop guessing where growth is leaking — and start fixing it with measurable ROI.

1️⃣ Map the Stack – “Where Is Your Growth Actually Breaking?”

Before spending a euro on ads or conferences, we map your startup across the 6 layers of the HealthTech Growth Stack:

-

Go-to-Market

-

Sales Automation

-

Marketing Intelligence

-

Partnerships

-

Funding

-

Revenue Intelligence

🔍 Deliverable:

A one-page GrowthVybz Radar Chart highlighting your strongest and weakest layers.

💡 Conversion hook:

We don’t just say “your marketing is weak.” We show the exact revenue impact of missing a CRM connection or a weak distribution partner.

(Full scoring system only available in the paid audit.)

Revenue Leak Estimator — “Pilot to Payment”

Estimate how much revenue your HealthTech is leaking each month across the 6 layers (GTM, Sales, Marketing, Partnerships, Funding, Revenue Intelligence). See your € upside in 30 seconds.

- Lead Conversion +0.6–1.0 pp

- SQL Rate +5–10 pp (better ICP & nurture)

- Close Rate +3–7 pp (partner & pricing fixes)

2️⃣ Measure the Leak – “Quantify the Invisible Losses”

Here’s where the real value kicks in.

Most startups have no idea what inefficiencies cost them monthly. We benchmark:

-

Missed funding due to no traction metrics

-

Lost revenue from poor lead nurturing

-

Underpricing vs. competitors

-

Partnership pipeline gaps

We use our proprietary GrowthVybz Leak Matrix — a diagnostic that estimates how much revenue slips away through unoptimized layers.

📈 Example:

A digital-therapy startup discovered it was losing €17 000/month by failing to retarget 80 % of free users post-trial.

💡 Conversion hook:

During your audit, we’ll quantify your exact leak in euros, so you see why this audit pays for itself.

3️⃣ Model the ROI – “Make the Business Case for Action”

Now we translate leaks into opportunities.

Using our Revenue Delta Calculator, we simulate the next 90 days:

-

What happens if you improve conversion by 10 %?

-

How much faster could you reach your next funding milestone?

-

How much ARR could you unlock if pricing was optimized?

This is where investors start listening — because they finally see commercial proof.

🧮 Deliverable (teased):

A dynamic ROI dashboard (Google Sheets / Data Studio) showing potential gains by fixing 3 top bottlenecks.

Full version only included in the paid Growth Readiness Audit.

4️⃣ Monetize the Fix – “From Strategy to Cashflow”

We don’t stop at insights — we execute.

For each weak layer, we implement quick-impact solutions:

-

GTM Enablement: Messaging and outbound sequences for 30 days.

-

Sales Automation: CRM + Apollo + LinkedIn integration in 72 hours.

-

Revenue Intelligence: Custom dashboards to track pipeline ROI.

-

Funding Activation: Connect traction metrics with investor platforms (PitchBook, EIT Health, Dealroom).

Average client ROI within 30 days: 3–5× audit cost.

💡 Conversion hook:

We don’t just “advise.” We help founders see new revenue within weeks, not quarters.

5️⃣ Maintain Momentum – “Turn Short-Term Wins Into Systems”

Once the leaks are fixed, the next challenge is consistency.

We set up a recurring analytics cadence — monthly or quarterly performance dashboards that track:

-

Lead-to-Revenue conversion

-

MRR growth per channel

-

ROI on partnerships and events

-

Pipeline velocity

This becomes your growth command center — updated automatically.

📊 Optional retainer:

€500–€900/month for ongoing reporting, optimization, and board-ready visuals.

💡 Conversion hook:

Most agencies disappear after the project.

GrowthVybz builds you a system that reports your ROI every month.

Conclusion: Europe’s HealthTech Growth Engine Has Arrived

HealthTech in 2025 isn’t just about innovation—it’s about integration.

The startups mastering these six layers are the ones converting funding into revenue and pilots into contracts.

GrowthVybz sits at the intersection of all six—helping founders, accelerators, and investors turn potential into predictable profit.

💡 Want your own custom Revenue Stack Audit?

DM “REVENUE MAP” or visit growthvybz.com/products/pipeline-growth-studio to book your 72-hour audit.